When it comes to following fuel management regulations, keeping up to date on IFTA compliance is key. From saving money to simplifying the tax process, there are a lot of benefits to following IFTA protocols. But calculating and filing fuel tax reports isn’t always the easiest task.

We’ve put together a helpful guide on the meaning of IFTA, how to calculate tax returns quarterly, and key tips to simplify the compliance process.

What Is IFTA Compliance?

IFTA is an acronym that stands for International Fuel Tax Agreement. IFTA is the agreement between 48 U.S. states (except Alaska and Hawaii) and 10 Canadian provinces (except Northwestern Territories, Nunavut, and Yukon) to simplify the reporting of motor carrier fuel.

The purpose of IFTA regulations is to maintain one fuel use license and jurisdiction for all motor carriers. This simplifies the tax process and results in cost and time savings.

To apply for an IFTA license, you’ll need:

- Carrier name

- Mailing address

- Federal business number

- USDOT number

Register your vehicle by contacting your base jurisdiction. Once your application is processed, your IFTA jurisdiction will send you a license and decals, also known as IFTA stickers

What Is an IFTA Sticker?

An IFTA sticker serves as proof of IFTA registration. Once registered, you’ll get a license in the mail and two IFTA decals to place on both sides of your fleet vehicle.

Your IFTA license and stickers expire on Dec. 31 of each year. You have until March 1 of the following year to register your IFTA license and current vehicle decals.

Who Needs to Comply With IFTA?

Drivers who operate qualified motor vehicles are subject to IFTA compliance.

IFTA manuals state that a qualified motor vehicle is used, designed, or maintained for the transportation of persons or property and:

- Has two axles and a gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms

- Has three or more axles regardless of weight

- Is used in combination, when the weight of such combination exceeds 26,000 pounds or 11,797 kilograms gross vehicle or registered gross vehicle weight.

If any of these apply to you, you’ll need to comply with IFTA regulations in order to avoid DOT penalties and fines.

How to Calculate IFTA Tax Returns

You can calculate your IFTA fuel tax returns by analyzing how much gas you burn in each state.

The IFTA tax calculation process involves five key steps, which include tracking mileage and fuel purchases to calculate taxes. You’ll then analyze tax rates for each jurisdiction to calculate your IFTA tax returns.

1. Track Miles

Track the miles you’ve traveled in each state to accurately record your fuel consumption.

You can do this by manually recording odometer readings when entering state lines, or by using ELD and compliance software combined with telematics which tracks GPS location, fuel consumption, mileage, inspections, and other vehicle performance data.

2. Add Fuel Purchases

The next step is to record the gallons of fuel purchased in each state or jurisdiction. You must collect original fuel receipts which contain:

- Fuel purchase date

- Fuel seller’s name and location

- Type of fuel purchased

- Vehicle plate number

- Number of gallons purchased

- Price per gallon

- Driver’s name

Once you’ve gathered your miles and fuel purchases, you can calculate overall consumption.

3. Calculate Fuel Consumption

Next, calculate the amount of fuel consumed by measuring miles driven in each jurisdiction versus total gallons purchased.

Use this simple formula to calculate fuel consumption: Total Miles Driven ÷ Total Gallons = Overall Fuel Mileage. You’ll need to calculate fuel mileage for each applicable jurisdiction.

4. Calculate Taxes Owed

To calculate taxes owed, you’ll need to determine the fuel tax rate for each state or jurisdiction. You can view the fuel tax chart to gather the tax rates for each state.

Keep in mind that tax rates may change and are not final until March 1.

5. Determine Fuel Tax

Finally, determine your fuel tax by calculating the tax amount owed in each jurisdiction. Gather the calculations from steps 3 and 4 and plug them into this simple formula: Fuel Tax Required in State X – Fuel Tax Paid in State X = Fuel Tax Owed to State X.

This will give you the fuel tax for each state or jurisdiction on your routes.

How IFTA reporting Works

Once calculated, you’ll report your fuel tax to your base jurisdiction. If you have vehicles registered in more than one state, you may be able to consolidate your returns under one license.

Determine if your IFTA portal has a digital process, in which case you’ll enter your calculations to view your tax return. If your jurisdiction requires paper filing, then you’ll enter the values from each of the steps above on the form provided.

When should you file IFTA tax returns?

IFTA requires motor carriers to file tax returns quarterly. Quarterly tax report deadlines include the following:

- 1st quarter deadline (January to March): April 30.

- 2nd quarter deadline (April to June): July 31.

- 3rd quarter deadline (July to September): October 31.

- 4th quarter deadline (October to December): January 31.

Be sure to file your tax returns by each of the quarterly deadlines to avoid any penalties or fines.

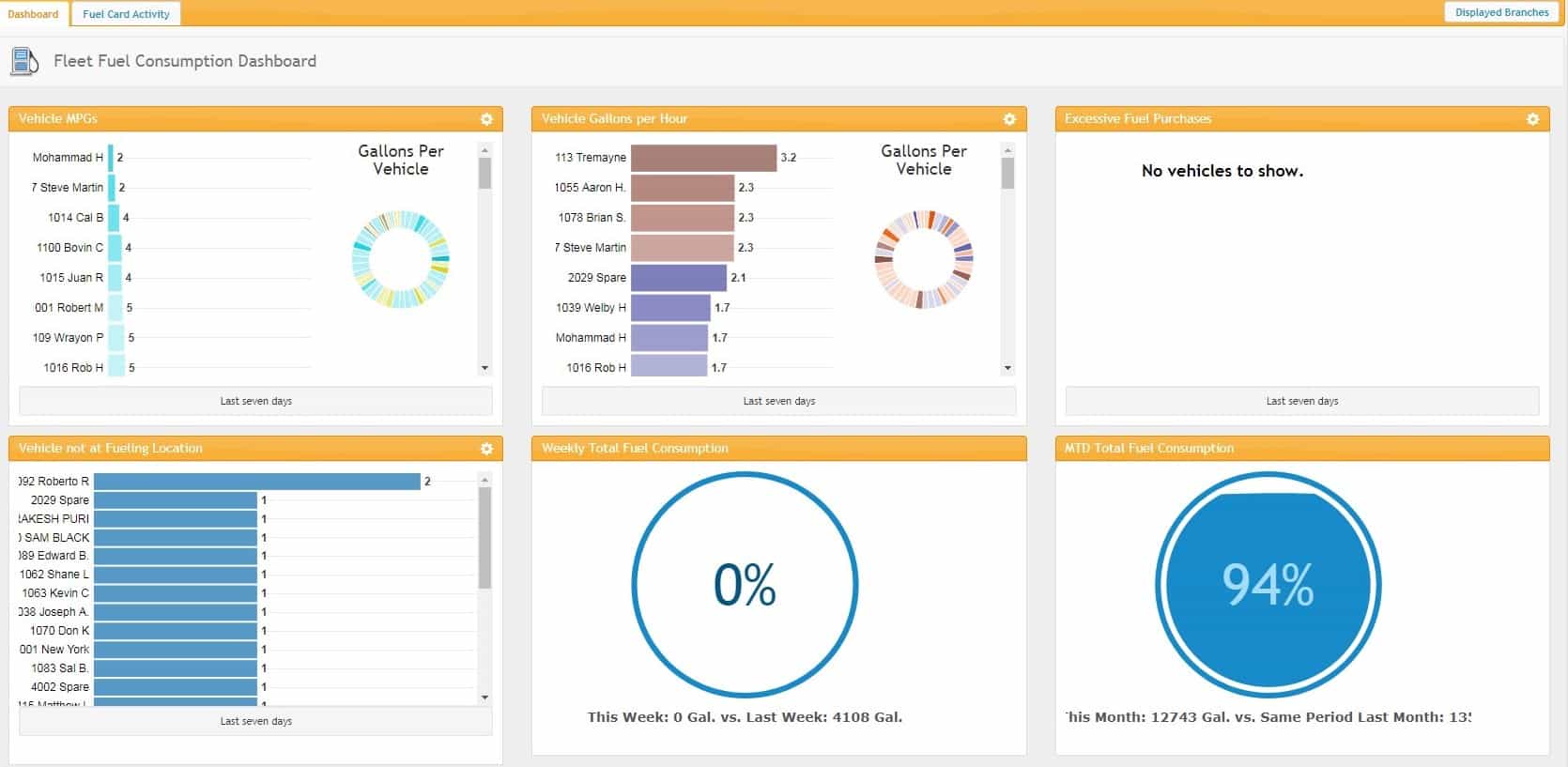

Visualize Trends with Fuel Management Data

With fuel consumption being a pain point for many fleet managers, it’s helpful to get a big picture understanding of fuel patterns. Visualizing trends can help you reduce fuel consumption and uncover opportunities for more streamlined protocols.

Take your fuel management process one step further with a combined fuel management and telematics solution. By connecting data from your fuel cards to performance and GPS insights from vehicle telematics, you’ll gain greater visibility into fuel consumption patterns and mileage data as they pertain to the vehicles location. This makes it a lot easier to map fuel spend to specific states or regions.

Analyzing trends with a fuel management system can help you:

- Report IFTA Compliance Data: A combined fuel management and telematics solution makes it easy to map your fleet’s mileage and fuel consumption to location data. This removes the manual work of calculating fuel tax data in each state. Typically, you’ll build digital reports to automate IFTA compliance reporting, which saves a ton of time in the process.

- Reduce fuel consumption: Fuel is one of the most costly facets of managing a fleet. This is why reducing fuel consumption is such an important factor when it comes to improving fleet efficiency. By identifying driver behavior that leads to unnecessary fuel burning, you’ll be able to reduce your overall fuel consumption.

- Eliminate Fuel Slippage: A reduction in unnecessary fuel consumption will save you money fast. But being able to monitor fuel card purchases and GPS location will make it obvious when a transaction occurred where no company vehicle was present. This is a big part in keeping employees accountable, and becoming a more sustainable fleet.

Learn how an intelligent fuel management system can connect fleet operations

![Episode 50 Thumbnail Erin celebrates building the fleet community with 50 episodes and 11K followers on LinkedIn [Podcast]](https://intellishift.com/wp-content/uploads/2020/08/Fuel_1600_1067.jpg)