The cost of fleet insurance is rising, and driver behavior and commercial fleet accidents are under a microscope. We don’t have to tell you how integral your drivers are to your organization, customer satisfaction and bottom line. Their health and safety are more critical to your business than any vehicle or piece of heavy equipment, so investing in their wellbeing and creating a safe and productive work environment are no-brainers.

But operating vehicles and equipment involves risk. Accidents are inevitable. Aside from the obvious danger to your drivers, accidents have a hugh impact on your fleet insurance.

Commercial Fleet Insurance Costs, By the Numbers

- The accident rate for commercial fleets is around 20%.

- Average annual insurance cost for fleets with new authority is $12,000 to $16,000.

- Average annual insurance cost for fleets with own authority is $9,000 to $12,000

- The average cost per incident for a large vehicle crash is $91,000.

- 80% of incidents that are routinely blamed on your drivers are not their fault.

Fleet Insurance is Expensive – And You’re Likely Paying More than Your Fair Share

If your driver gets into an accident, there are a wide range of problems that could arise after the fact. You could be liable to pay damages, including for the 80% of incidents that are not your driver’s fault. What are the steps to have concrete proof that your driver was not responsible for the accident?

And beyond commercial fleet insurance and claim costs, accidents trigger an entirely different set of business costs beyond the cost of repairing the vehicle. As a manager, it’s important for you to do all that you can to keep your assets on the road. When a vehicle (and potentially the driver as well) experience downtime due to necessary repairs, that downtime translates into dollars. Vehicle downtime costs an average of $448 to $760 a day per vehicle, and that adds up quickly.

If a vehicle can no longer be used following an accident even for a short period of time, your productivity goes down and you won’t be able to deliver on your promise to your customers.

What’s more, if the goods in the vehicle are damaged, you will have to deal with further insurance claims to recuperate those lost costs. You likely already have a well-thought-out safety process in place, but how are you protecting your business and drivers from incidents that aren’t your fault?

False Insurance Claims: Are You Able to Tell if Your Driver is Really to Blame?

In fatal accidents between cars and commercial vehicles, commercial vehicles are only responsible about 25% percent of the time. You need to prepare to exonerate your drivers from the accidents that aren’t .

“Sometimes drivers do get blamed for things they don’t do,” said Joe Gallitto of DJ Ambulette in a recent Connected Ops Visionaries Podcast episode.

“It’s kind of difficult to tell a customer, ‘sorry, you’re wrong,’ continued Gallitto. “But we’re able to go to a video and show exactly what happened. That was revolutionary for us. Drivers, after a few months and a couple incidents, were able to see that this was a tool not just for us, it was for them.” DJ Ambulette’s drivers now request video footage when incident claims come in.

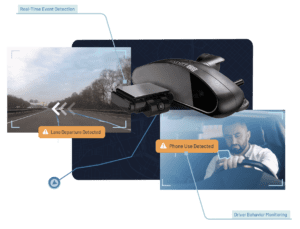

How to Fight False Claims and Lower Insurance Costs

The best way to prove your driver’s innocence and avoid fleet insurance payouts is to arm yourself with indisputable evidence. This evidence can come in many forms, but fleets are beginning to recognize the importance of in-cab video safety technology. Fleet dash cams like those that DJ Ambulette use provide video evidence of how exactly an incident went down. AI Video dash cams go a step further, autmotically capturing footage of events and sending them directly to your safety platform for you to review. All you have to do is send them to the appropriate authorities to show what transpired.

Develop an accident response policy where you and drivers go through a checklist of best practices, including reviewing the driver and road-facing video footage to determine fault. You can also use footage and alerts as part of a broader driver coaching program. In time, you’ll see improvements in accident avoidance, and are sure to see lower fleet insurance costs across your mobile operation.

Download the Exonerating Driver’s eBook to learn how fight the 80% of false claims they face.

![Episode 50 Thumbnail Erin celebrates building the fleet community with 50 episodes and 11K followers on LinkedIn [Podcast]](https://intellishift.com/wp-content/uploads/2021/02/AI_Video_Cab_Blurred.jpg)